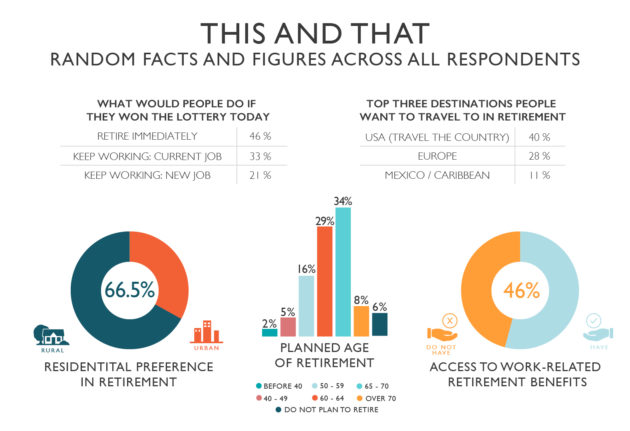

So what would you do if you won the lottery? Would you quit working? For many of us, the answer is yes, but according to a recent survey conducted by AAG, the majority of Americans would actually prefer to keep their day job, or at least pick up a new one, rather than opting for an early retirement. This was a bit of a surprise, but it was far from the only eye-opening response. Let’s take a look at what else this retirement study revealed and how responses varied by generation.

We’ll start with the basics. When asked what age they planned to retire, 34% of Americans said between the ages of 65-70 and 29% said between 60-64. A shocking 6% said they did not ever plan to retire and on the other end of the spectrum, 2% are hopeful they’ll retire before 40. When they do retire, the vast majority are hoping to live in a rural community versus an urban one. It is a little worrisome, however, that 54% of those surveyed had no access to retirement benefits at work, meaning they will need to rely on their own personal savings or the government to survive their later years.

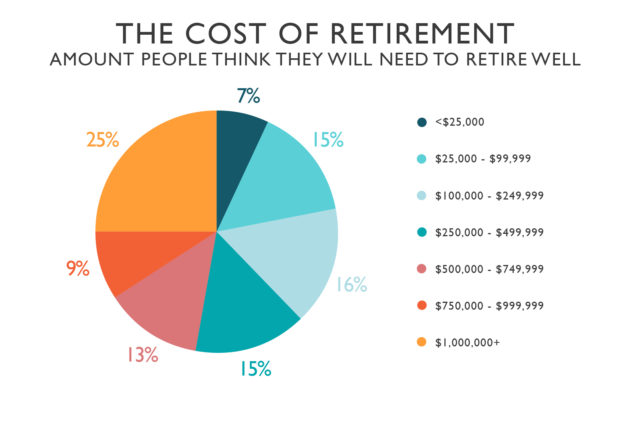

Other responses were a bit less cut and dry. Anticipated cost of retirement, for example, had a pretty even distribution among all answer choices with $1,000,000 being the most popular. 7% of people believed they could live on $25,000 after retiring.

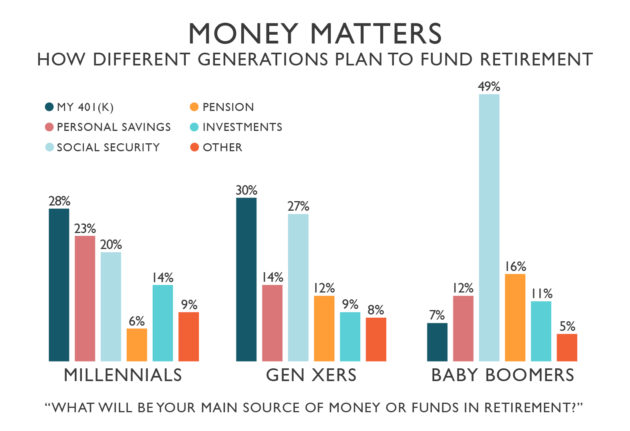

Generational divides were very apparent when asking Americans how they would fund their retirement. Millennials are counting on their 401k and personal savings while Baby Boomers are planning to rely heavily on Social Security payments and their pensions. Gen Xers were somewhere in the middle, hoping to use both Social Security and personal savings to fund their retirement.

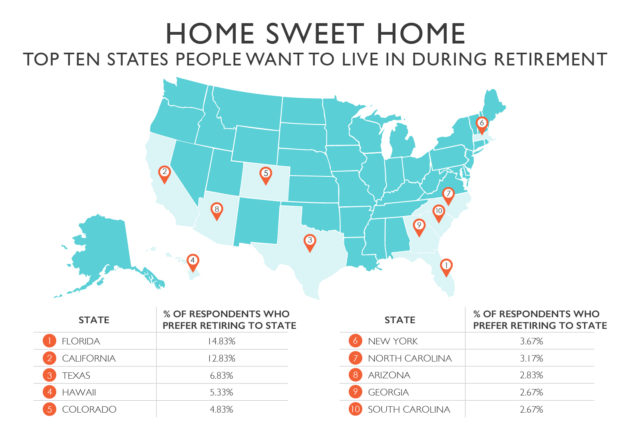

Now that we know the who, what, and how, let’s explore where these retirees are heading after their work comes to an end. According to the survey, the top five retirement destinations for Americans are Florida, California, Texas, Hawaii, and Colorado.

There’s a lot to be gained from looking at how American responded to these questions. Bottomline is, no matter how old you are or where you’re from, planning for retirement is an important part of life. It’s never too early to start saving and laying out your retirement goals. In fact, the sooner you do so, the closer you are to never having to work again.